Medicare Supplement Insurance

Do I need a Medicare Supplement Insurance Policy?

Medicare is an essential part of every Senior’s health planning, but it was never intended to provide for all your healthcare expenses. Escalating healthcare costs continue to leave many expenses that Medicare does not cover. Unless you have supplemental insurance coverage, these expenses come out of your pocket.

Choosing a Medicare Supplement Insurance Plan

Medicare Supplement insurance plans are the same by law. Depending on the plan you select, coverages pay various Medicare deductibles, coinsurances, and other medical expenses not covered by Medicare. However, insurers’ rates and services vary, which makes it very important for Seniors to shop carefully to get the best value for their dollars.

Globe Life Insurance Company of New York offers

11 of the 12

Standardized Medicare Supplement plans –

A, B, C, D, F, F+, G, G+, K, L, and N.

A Globe Life Insurance Company of New York representative can help you choose which plan best suits your needs for the long term.

Who’s eligible for coverage?

If you are age 65 or older and enrolled in Medicare Parts A and B, you are eligible for Medicare Supplement insurance coverage. You are also eligible if you are under age 65 and qualify for Medicare due to disability.

When to purchase

If you are 65 or older and still working, you may want to wait to enroll in Medicare Part B if you have health coverage through an employer or union based on your (or your spouse’s) current or active employment.

What does each Medicare Supplement insurance plan pay?

All Medicare Supplement standardized insurance plans include the following basic benefits:

- Hospitalization: Part A coinsurance plus coverage for 365 additional days after Medicare benefits end

- Medical Expenses Insurance: Part B coinsurance (generally 20% of Medicare-approved expenses) or copayments for hospital outpatient services. Plans K, L, and N require insureds to pay a portion of the Part B coinsurance or copayments.

- Blood: First three pints of blood each calendar year

- Hospice: Part A coinsurance for eligible hospice/respite care expenses

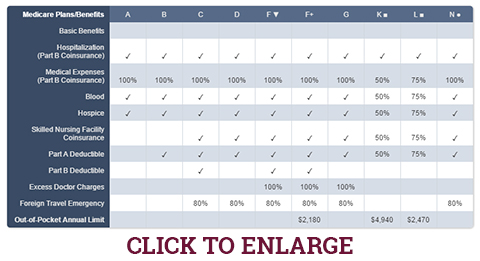

The Medicare Supplement Insurance Plan Benefit chart below shows the benefits included in each plan.

In New York, all Medicare Supplement insurers must offer Plans A and B and either Plan D or Plan G.

Medicare Supplement Insurance Plan Benefits

Only applicants first eligible for Medicare Part A before 2020 may purchase Plans C, F, and High Deductible Plan F.

| |

Plans Available to All Applicants |

Medicare First Eligible Before

2020 Only |

| Benefits |

A |

B |

D |

G ▼ |

K ■ |

L ■ |

N ● |

C |

F ▼ |

Medicare Part A coinsurance

and hospital coverage

(up to an additional 365 days

after Medicare benefits are used up) |

|

|

|

|

|

|

|

|

|

Medicare Part B coinsurance

or copayment |

|

|

|

|

50% |

75% |

●

Copays |

| |

| Blood (first three pints) |

|

|

|

|

50% |

75% |

|

|

|

| Hospice |

|

|

|

|

50% |

75% |

|

|

|

Skilled Nursing

Facility Coinsurance |

|

|

|

|

50% |

75% |

|

|

|

| Medicare Part A Deductible |

|

|

|

|

50% |

75% |

|

|

|

| Medicare Part B Deductible |

|

|

|

|

|

|

|

|

|

| Medicare Part B excess charges |

|

|

|

100% |

|

|

|

|

100% |

Foreign travel emergency

(up to plan limits) |

|

|

|

|

|

|

|

|

|

Out-of-Pocket limit

in

2026 ■ |

|

|

|

|

$8,000 |

$4,000 |

|

|

|

- ▼ Plans F and G also have a high deductible option which requires first paying a plan deductible of

($2,950 in 2026)

before the plan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year. High Deductible Plan G does not cover the Medicare Part B deductible. However, High Deductible Plan G counts your payment of the Medicare Part B deductible toward meeting the plan deductible.

- ■ Plans K and L pay 100% of covered services for the rest of the calendar year once you meet the out-of-pocket yearly limit

($8,000 for Plan K, $4,000 for Plan L in 2026).

The out‑of‑pocket annual limit does NOT include the charges from your provider that exceed Medicare-approved amounts which are called ‘excess charges.’ You will be responsible for paying excess charges. The out‑of‑pocket annual limit may increase each year for inflation.

- ● Plan N pays 100% of Medical Expenses (Part B Coinsurance) except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission. The emergency room copayment is waived if the insured is admitted to any hospital and the emergency visit is covered as a Medicare Part A expense.

Globe Life Insurance Company of New York’s Medicare Supplement insurance policies give you the freedom to choose from providers and hospitals that accept Medicare.*

Request more information to determine which plan best fits your needs and budget.

IMPORTANT: To be eligible for a Medicare Supplement insurance policy, you must be enrolled in both Medicare Part A and B.

Visit https://www.medicare.gov/ to learn more about Part A and B coverage.

New York Medicare Supplement Open Enrollment

New York State law and regulation require companies issuing Medicare Supplement insurance policies (Medigap) to accept applications from Medicare enrollees at any time throughout the year. Insurers are not permitted to deny an applicant a Medigap policy or make premium rate distinctions based on the applicant’s health status, medical condition, claims experience, or if the applicant is receiving healthcare treatment.

Learn more about regulatory requirements for Medicare Supplement plans in New York.

“Automatic” Claims Filing® (ACF®) – Medicare Supplement Insurance Claims Filing Made Easier

When you’re recovering from an illness, the last thing you want to deal with is filing your insurance paperwork. Globe Life Insurance Company of New York’s “Automatic” Claims Filing® practically eliminates your need to file Medicare Part B claims. And best of all – your claims can be paid quickly and accurately.

- Helps Eliminate Claims Filing Headaches: Globe Life Insurance Company of New York receives your Part B claims directly from Medicare so you may never have to deal with the hassle of submitting insurance paperwork.

- Speeds Claims Delivery: No waiting for you or your doctor to send claims to the insurer. The benefit check for the healthcare provider is usually in process before you receive your Medicare Summary Notice.

- No Missed Claims: ACF® helps prevent lost or misfiled claims so all eligible benefit dollars due under your policy are paid.

Medicare FAQs

AEP takes place every year from October 15 to December 7.

MA OEP takes place every year from January 1 to March 31.

MA OEP pertains to Seniors who are enrolled in a Medicare Advantage plan. During MA OEP, Seniors can change their previous Medicare Advantage coverage choice. They can drop their current plan or switch from a

Medicare Advantage plan to Original Medicare or from a

Medicare Advantage plan to another Medicare Advantage plan.

Read more about Medicare Advantage Open Enrollment Period.

The purpose of this communication is the solicitation of insurance. Globe Life Insurance Company of New York is not connected with, endorsed by, or sponsored by the U.S. government, federal Medicare program, Social Security Administration, or the Department of Health and Human Services.

Medicare Supplement insurance POLICY FORMS GNYMSA10, GNYMSB10, GNYMSC10, GNYMSD10, GNYMSF10, GNYMSHDF10, GNYMSG10, GNYMSHDG, GNYMSK06, GNYMSL06, and GNYMSN10 are available from our Company. These policies meet the minimum standards for MEDICARE SUPPLEMENT INSURANCE as defined by the New York State Department of Financial Services.The expected benefit ratio for this policy is 65%. This ratio is the portion of future premiums which the Company expects to return as benefits, when averaged over all people with this policy.

NY requires that these plans be available to persons under age 65 eligible for Medicare due to disability or End Stage Renal disease (ESRD). Only Applicants first eligible for Medicare before 2020 may purchase Plans C, F, and F+. You may be contacted by an agent representing Globe Life Insurance Company of New York. A licensed agent will provide additional information upon request.

IMPORTANT NOTICE – A CONSUMER’S GUIDE TO HEALTH INSURANCE FOR PEOPLE ELIGIBLE FOR MEDICARE MAY BE OBTAINED FROM YOUR LOCAL SOCIAL SECURITY OFFICE OR FROM THIS INSURER.

Read our Narrative Summary to learn more about premium rate changes for Individual Medicare Supplement plans.

*Standard feature on all Medicare Supplement Insurance polices.

AD-1347